Inpatient Drug Rehab Coverage: 7 Essential Insurance Facts You Need to Know

Hannah is a holistic wellness writer who explores post-traumatic growth and the mind-body connection through her work for various health and wellness platforms. She is also a licensed massage therapist who has contributed meditations, essays, and blog posts to apps and websites focused on mental health and fitness.

Hannah is a holistic wellness writer who explores post-traumatic growth and the mind-body connection through her work for various health and wellness platforms. She is also a licensed massage therapist who has contributed meditations, essays, and blog posts to apps and websites focused on mental health and fitness.

Table of Contents

- What Is Inpatient Drug Rehab?

- Insurance Coverage Basics for Inpatient Rehab

- 1. Most Private Insurance Plans Cover Inpatient Drug Rehabilitation

- 2. Medicare Part A Pays for Medically Necessary Residential Treatment

- 3. Medicaid Coverage Varies by State but Always Includes Some Treatment Options

- 4. The Mental Health Parity Act Requires Equal Coverage for Addiction Treatment

- 5. Payment Options Exist for Rehab Without Insurance

- 6. Financial Assistance Programs Can Help Cover Costs Insurance Won’t

- 7. Rehab Centers Have Specialists Who Verify Your Benefits at No Cost

- Taking Action on Insurance Coverage Today Removes Barriers to Recovery

Making the decision to seek help for addiction is a huge step toward recovery. If you or your loved one is considering inpatient drug rehab, understanding insurance coverage is an important part of the process.

Most rehab centers have dedicated staff who help patients navigate insurance coverage. These admissions specialists work directly with insurance companies to verify benefits and handle much of the paperwork. This is especially helpful when dealing with insurance details feels overwhelming—and when you need to focus on getting help for drug or alcohol addiction.

This guide breaks down the basics of inpatient rehab coverage, including private insurance, Medicare, and Medicaid options. We’ll also explore payment plans, financial assistance programs, and what to expect during the admissions process. Fortunately, treatment centers are there to help with both recovery and the practical details that make treatment possible.

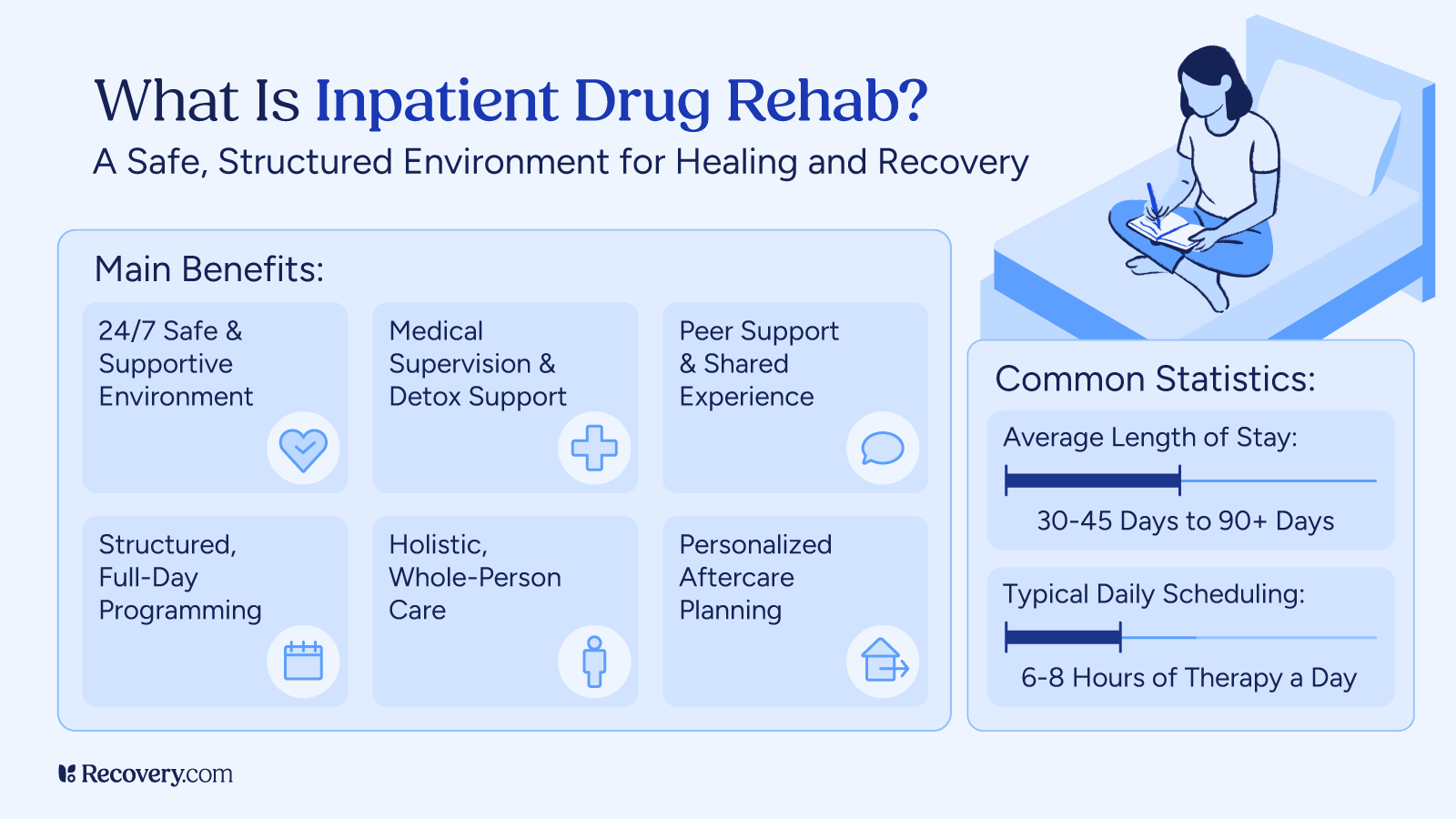

What Is Inpatient Drug Rehab?

Inpatient drug rehab is a residential treatment program where you stay at a facility 24/7 while receiving care for substance use disorders in a structured environment away from the triggers and stress of daily life. Programs typically last 28 days to several months and provide comprehensive care including individual therapy, group counseling, educational sessions, and wellness activities.

This level of care is usually recommended for people with more severe drug addiction, those who have tried outpatient treatment without success, people who need medical supervision during withdrawal, and those who could benefit from time away from challenging home environments.

Insurance Coverage Basics for Inpatient Rehab

Understanding insurance coverage for rehab starts with knowing your plan type. Most health insurance plans cover some form of addiction treatment, but the details vary widely. There are 4 main types of health insurance plans that affect how your rehab is covered:1

- HMO plans require you to work with a primary care doctor who refers you to specialists, including addiction treatment. With an HMO, you may need your healthcare provider’s approval for inpatient rehab coverage.

- PPO plans give you more freedom to choose providers. You’ll pay less for in-network facilities, but out-of-network rehabs may still offer some health coverage at a higher cost.

- EPO plans work like HMOs but with fewer treatment provider options. Your rehab coverage depends on whether the treatment facility is in their network.

- POS plans combine features of HMOs and PPOs. You’ll usually need a primary care doctor for referrals, but may have some out-of-network options at higher costs.

1. Most Private Insurance Plans Cover Inpatient Drug Rehabilitation

Most private insurance plans offer coverage for inpatient drug rehab.2 Major providers like Blue Cross Blue Shield, Aetna, UnitedHealthcare, Cigna, and Humana typically include addiction treatment in their benefits. The amount covered varies by plan, but many cover a substantial portion of the costs.

A key factor affecting your costs is whether the rehab facility is in-network or out-of-network with your insurance policy. In-network means the facility has an agreement with your insurance company, resulting in lower out-of-pocket costs for you. Out-of-network treatment may still have some coverage, but you’ll likely pay more.

Rehab centers have dedicated staff who work directly with insurance companies. They handle verification calls, submit required paperwork, and sometimes even negotiate better coverage on your behalf. Many also help with appeals if your insurance initially denies coverage. The admissions team should explain what your plan covers before you commit to treatment, so you don’t encounter any surprise charges.

2. Medicare Part A Pays for Medically Necessary Residential Treatment

Medicare covers inpatient drug and alcohol rehab (and partial hospitalization) primarily through Medicare Part A (hospital insurance).3 This includes services like room and board, nursing care, therapy, and medications during your stay.

While there’s no fixed limit on treatment plan length, Medicare requires that your care is medically necessary.4 This means your doctor needs to document that your condition requires treatment that can’t be provided in an intensive outpatient program. Coverage decisions are based on your individual needs rather than a predetermined number of days.

Rehabs that accept Medicare have staff who understand its guidelines and can help verify your coverage. They’ll explain any co-payments or deductibles you might be responsible for and ensure your drug or alcohol treatment meets Medicare’s requirements for coverage.

3. Medicaid Coverage Varies by State but Always Includes Some Treatment Options

Medicaid does cover inpatient drug rehab in all states, though coverage details vary depending on where you live.5 Since Medicaid is a joint federal and state program, each state creates its own rules about which treatment services are covered and for how long.

To qualify for Medicaid, you must meet income requirements and other eligibility criteria specific to your state. In states that expanded Medicaid under the Affordable Care Act, more people with substance use disorders can access coverage.

Finding rehabs that accept Medicaid can sometimes be challenging. Not all treatment centers participate in the program. However, many state-funded facilities and some private centers do accept Medicaid patients. When contacting a rehab center, always ask specifically about Medicaid acceptance. Their admissions team can verify your benefits and help you understand what’s covered. If they don’t accept Medicaid, many will refer you to facilities that do.

4. The Mental Health Parity Act Requires Equal Coverage for Addiction Treatment

The Mental Health Parity and Addiction Equity Act is an important law that helps people seeking addiction treatment. This law requires insurance companies to cover mental health care and substance abuse treatment at levels comparable to medical services. This means they can’t charge higher copays or set stricter limits just because you’re seeking addiction treatment.6

5. Payment Options Exist for Rehab Without Insurance

Without insurance, inpatient drug rehab typically costs between $10,000 and upwards of $50,000 for a 30-day program. Luxury facilities or longer stays may cost considerably more. These costs cover everything from room and board to therapy for mental health conditions, medical care, and other services provided during treatment.

Many treatment centers offer options to make rehab more affordable. Sliding-scale fees adjust the cost based on your income. Some facilities offer payment plans so you can spread the cost over time instead of paying all at once.

Rehab admissions specialists can discuss financial options and help determine what might work for your situation. Some centers offer scholarships or reduced rates for those in financial need. While these options are limited and often have waiting lists, they’re worth exploring if you’re struggling financially.

6. Financial Assistance Programs Can Help Cover Costs Insurance Won’t

Beyond insurance, there are several ways to get help paying for addiction treatment. Many states have dedicated funding for substance use treatment through their departments of health or social services. These programs may cover part or all of the cost of inpatient care for eligible residents.

Some non-profit organizations offer scholarships or grants specifically for addiction treatment. These may include faith-based organizations and local charities.

Rehabs often know about various funding sources and can help you explore options you might not find on your own. Their admissions teams work with these programs regularly and understand how to navigate the application processes. Don’t hesitate to ask about financial assistance when contacting treatment centers—helping you access care is part of their job.

7. Rehab Centers Have Specialists Who Verify Your Benefits at No Cost

When you contact a rehab center, their admissions team can immediately begin helping you with insurance matters. The process typically starts with a brief assessment of your needs, followed by collection of your insurance information. With your permission, they’ll contact your insurance provider directly to verify your benefits.

During verification, the rehab center confirms what services are covered, how long treatment will be approved, and what out-of-pocket costs you’ll have. They’ll also handle any pre-authorization requirements and submit clinical information to justify your need for treatment.

All you’ll need to provide is your insurance card, ID, and permission for the facility to communicate with your insurance company. Beyond that, the admissions team handles most of the complex insurance work. They’ll explain your coverage in simple terms and answer any questions about the financial aspects of treatment.

If your insurance denies coverage, the rehab center can help with the appeals process. They’ll provide additional documentation or clarification about why inpatient treatment is medically necessary for your situation. Many facilities have high success rates with appeals because they understand what insurance companies need to approve coverage.

Taking Action on Insurance Coverage Today Removes Barriers to Recovery

Choosing a better life is brave, and you deserve support every step of the way—including with concerns about insurance and payment. Most rehab centers have staff ready to help you navigate these details so you can focus on healing.

That said, being your own advocate throughout this process is important. If you encounter roadblocks, don’t be afraid to ask specific questions like “What documentation do you need for approval?” or “Why isn’t this service covered and what are my alternatives?” Keep records of all conversations, including names and reference numbers.

If you can’t get clear answers, you may want to call a different rehab. Your treatment center should have no problem providing all the information you need to make an informed decision about your care.

It’s common to find this process overwhelming. Your loved ones can help make calls, organize paperwork, or attend meetings with admissions. Having support makes navigating these systems less overwhelming during an already difficult time.

When dealing with insurance matters, persistence pays off. Your recovery is worth fighting for, and you deserve access to the care you need.

Start Your Search for Covered Treatment Today

Search for a rehab that takes your insurance and contact their admissions team today to explore your options. The path to recovery starts with a single call.

FAQs

-

HealthCare.gov. (n.d.). Health insurance plan & network types: HMOs, PPOs, and more. U.S. Department of Health & Human Services. https://www.healthcare.gov/choose-a-plan/plan-types/

-

Institute of Medicine (US) Committee for the Substance Abuse Coverage Study, & Gerstein, D. R., & Harwood, H. J. (Eds.). (1990). Treating drug problems: Volume 1: A study of the evolution, effectiveness, and financing of public and private drug treatment systems. National Academies Press (US). https://www.ncbi.nlm.nih.gov/books/NBK235505/

-

Centers for Medicare & Medicaid Services. (n.d.). Mental health & substance use disorders. Medicare.gov. https://www.medicare.gov/coverage/mental-health-substance-use-disorder

-

Medicare Rights Center. (2025, March 31). Treatment for alcoholism and substance use disorder. Medicare Interactive. https://www.medicareinteractive.org/get-answers/medicare-covered-services/mental-health-services/treatment-for-alcoholism-and-substance-abuse

-

U.S. Centers for Medicare & Medicaid Services. (n.d.). Substance use disorders resources. Medicaid. https://www.medicaid.gov/medicaid/benefits/behavioral-health-services/substance-use-disorders

-

Centers for Medicare & Medicaid Services. (2024, September 10). The Mental Health Parity and Addiction Equity Act (MHPAEA). U.S. Department of Health & Human Services. https://www.cms.gov/marketplace/private-health-insurance/mental-health-parity-addiction-equity

Our Promise

How Is Recovery.com Different?

We believe everyone deserves access to accurate, unbiased information about mental health and recovery. That’s why we have a comprehensive set of treatment providers and don't charge for inclusion. Any center that meets our criteria can list for free. We do not and have never accepted fees for referring someone to a particular center. Providers who advertise with us must be verified by our Research Team and we clearly mark their status as advertisers.

Our goal is to help you choose the best path for your recovery. That begins with information you can trust.